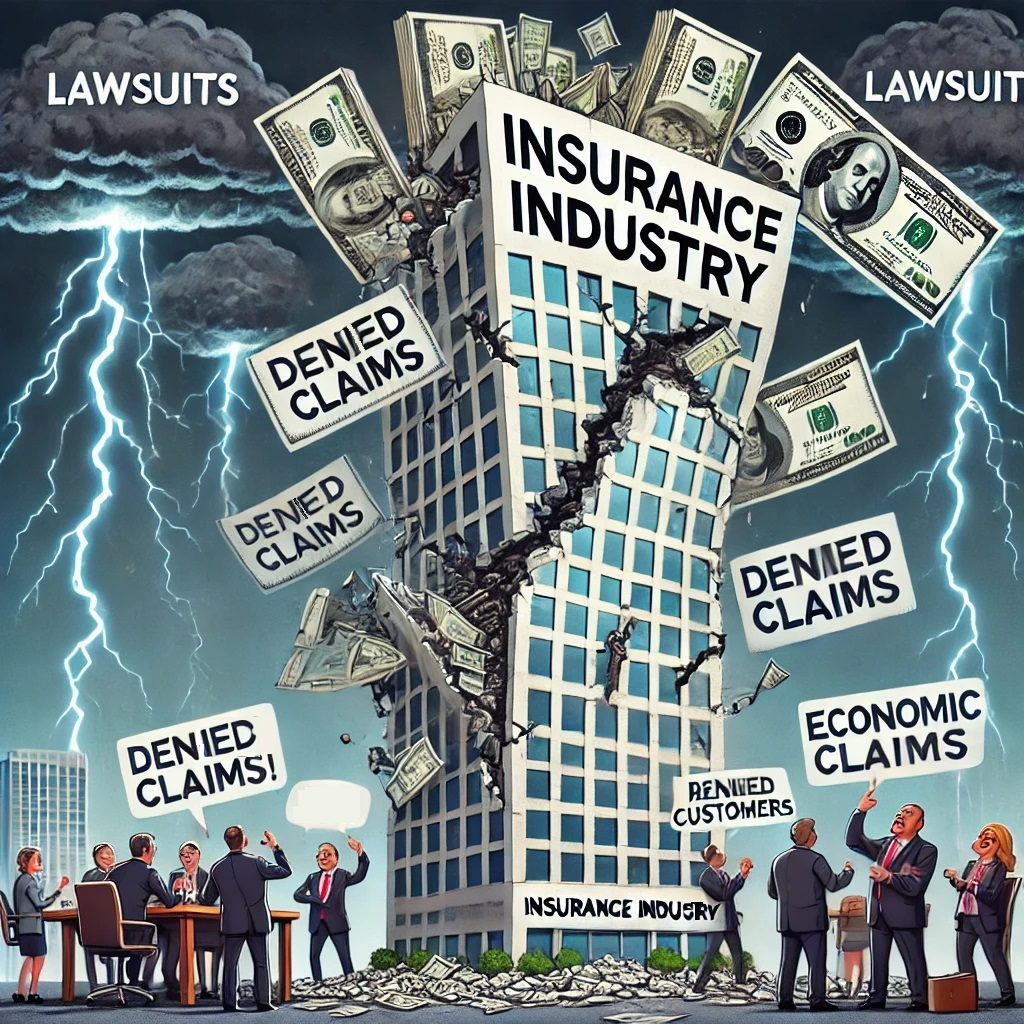

The insurance industry is essential in providing financial protection to individuals and businesses, but recent events and trends have revealed a number of troubling issues that are affecting policyholders and their experiences with insurance companies. These problems are becoming harder to ignore and have raised questions about how the industry should adapt to meet the needs of consumers, as the consumer is quickly becoming the victim to the seeming whims of the insurance industry.

One major issue is the drastic rise in homeowners’ insurance premiums, especially in places that are prone to natural disasters like hurricanes and wildfires. According to data from the U.S. Treasury Department, homeowners in high-risk areas paid up to 82% more in premiums between 2018 and 2022 compared to those living in areas with lower risks. This increase is largely due to the rising frequency and severity of climate related events, which have caused some insurance companies to pull out of states like California and Florida. As a result, many homeowners are seeing their policies canceled, leaving them vulnerable and financially strained.

On top of rising premiums, dealing with insurance claims can be a complicated process. Policyholders often find themselves facing delays and disputes over what is covered, making it hard to get the support they need. For example, in automobile insurance, if someone is in an accident but wasn’t wearing their seatbelt, the insurance company might argue that the injuries were more severe because the person wasn’t following safety precautions, resulting in a reduced payout, leaving the person with less financial help than they were expecting.

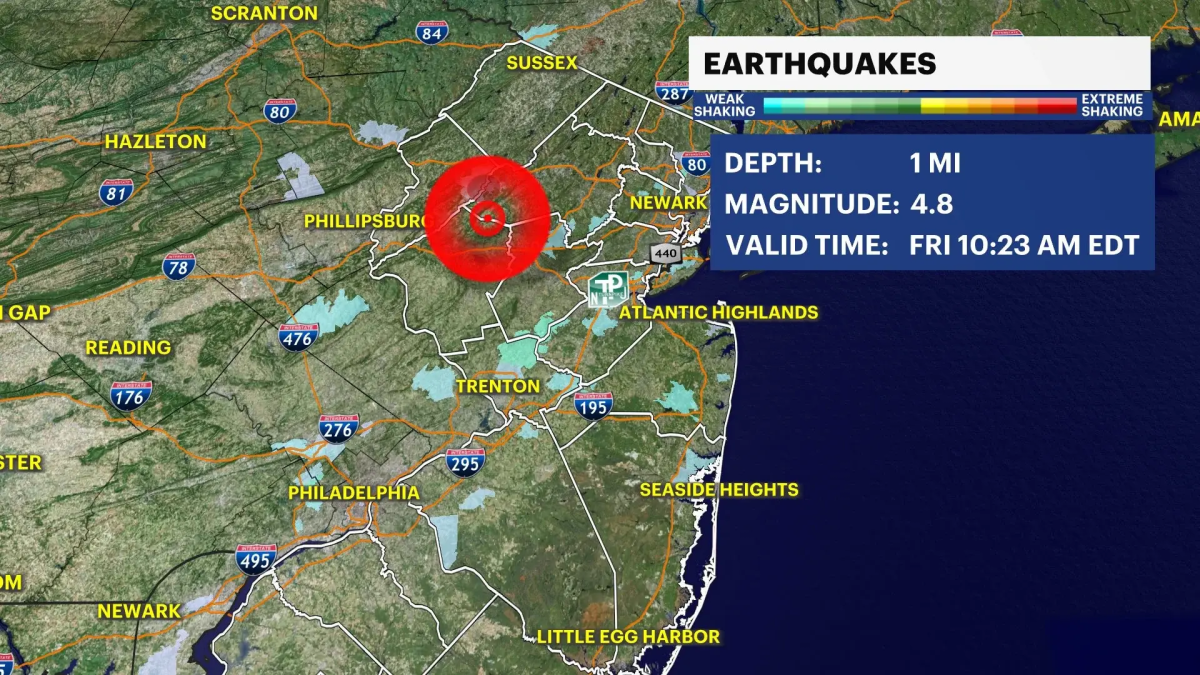

Climate change also has a major impact on the insurance sector. As natural disasters become more frequent, the cost of reinsurance (which is insurance for insurance companies) has skyrocketed, with losses from natural catastrophes now averaging $150 billion annually. This not only affects the bottom line for insurance companies but also has a ripple effect on premiums, making it harder for consumers to afford coverage.

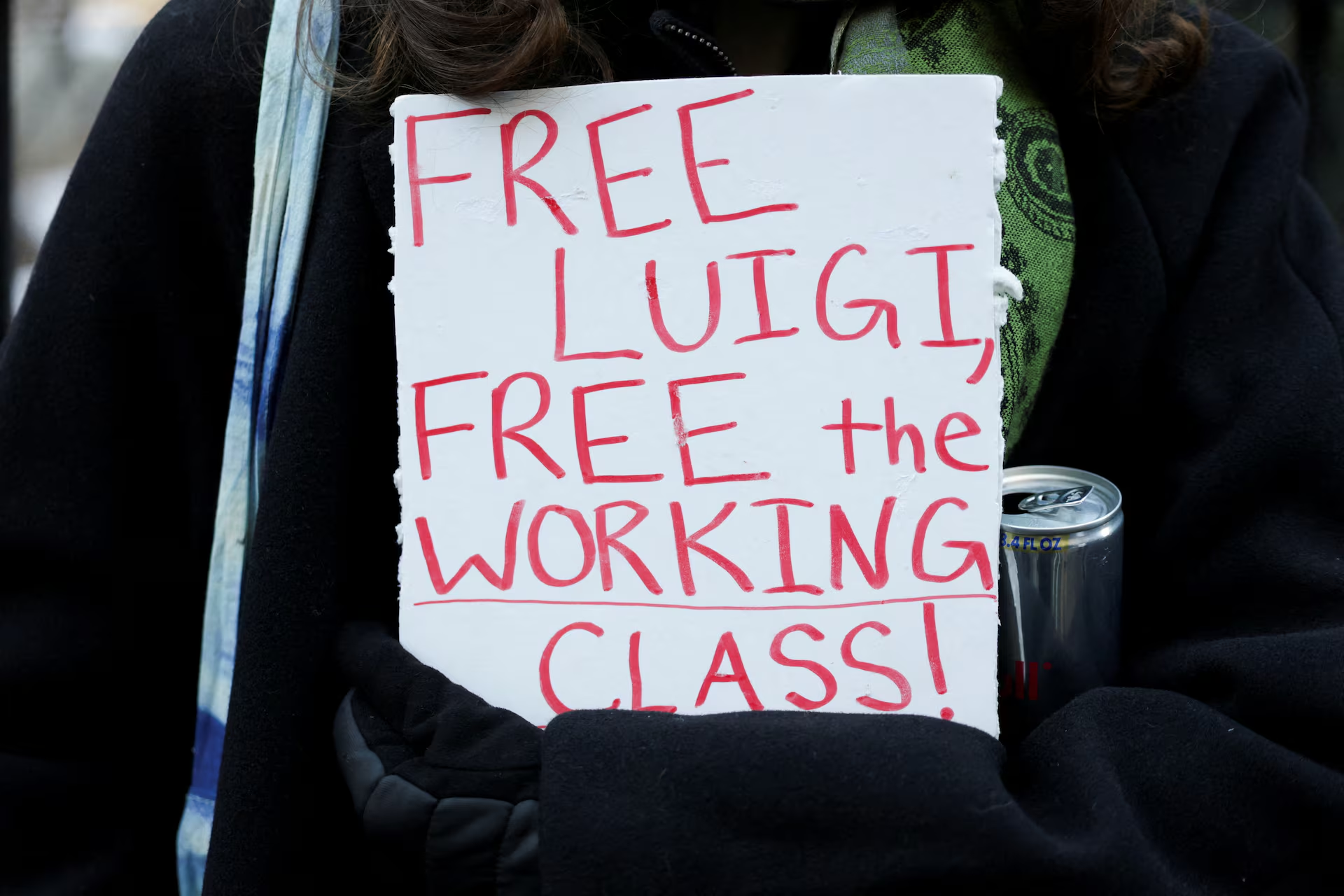

The recent case of Luigi Mangione brings these issues to the forefront in a more dramatic way. Mangione, who has been accused of killing a CEO from UnitedHealthcare, has been painted as a sort of “Robin Hood” figure by some of his supporters. They claim his actions were in response to the greed and corruption they see in big insurance companies that prioritize profits over the well-being of their customers. While the case itself is still unfolding, it has sparked conversations about how far some people are willing to go when they feel that the system is rigged against them, as well as spotlighting the frustration of so many who have been spurned by the insurance system.

The insurance industry is facing a critical moment, dealing with rising premiums, complicated claims processes, and the effects of climate change. In order to keep up with these challenges, insurers will need to find new ways to adapt and innovate, all while keeping the best interests of policyholders at the center of their efforts.

The challenges facing the insurance industry aren’t just abstract national issues—they directly impact local communities like Putnam County. Despite living in a region that should offer access to quality healthcare, many residents find themselves struggling with the same systemic problems.

Living in Putnam County should mean having access to reliable healthcare, but for many residents, that’s not the case. It’s frustrating to hear about friends and neighbors paying for costly health insurance only to find out they can’t use it when they need it most.

A major problem is that some insurance plans have very few doctors in their networks. If your doctor isn’t “in-network,” your insurance might not cover the cost of your visit, and you could end up with a big bill. Many people in Putnam County have trouble finding “in-network” doctors nearby. This makes it harder for families to get the care they need without driving long distances or paying extra.

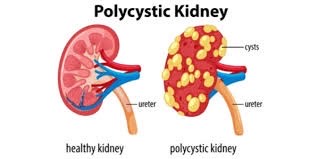

Monthly premiums for plans in our area can be over $1,200, who shows another issue: the high cost of insurance itself. That’s a huge amount of money, and it’s not even guaranteed to cover all your medical needs. Some residents have been denied coverage for important treatments or found that hospitals they need to visit aren’t included in their insurance plans.

Imagine needing specialized care at a hospital outside the county, only to be told that your insurance won’t cover it. You’re left with two bad choices: travel far to find someone in-network or pay out of pocket. UnitedHealth Group, the nation’s largest health insurer, has been criticized for delaying or denying patient care to boost profits. That’s not fair, especially when people are already paying significant amounts for their insurance.

There are programs to help, like New York’s State of Health Marketplace, which gives advice about choosing and using insurance. But even with help, the bigger issue is clear: the system isn’t working.

We need insurance companies to be transparent about what they cover and to provide better options for not just residents of Putnam County, but citizens everywhere. Additionally, we need leaders to take action and ensure families can access affordable healthcare. One way we can foster change is by creating a forum directed towards our local officials, such as our Putnam County Executive, Kevin Byrne, taking in account the voices of our residents and their personal experiences. Citizens can also call to action, initiating public meetings to advocate for themselves and to gain legislative support for reforms. Everyone deserves the right to see a doctor and receive the treatment they need without financial hardship, and by taking actions on a local level, we can start to enact that change.